श्री Yogesh Ashok Powar

Personal Blogs

India Fintech Open Source Stack

Why Indian Fintech Industry need a open source stack

Tags: Fintech India Open SourceWhen we started Orowealth, I remember that we used to collect wet signatures for mutual fund KYC. There were human runners who would go door-to-door to collect the signed documents. This later changed to signing on the screen and then using Aadhaar-based e-signatures. Every other startup that emerged during that time aimed to automate tedious manual tasks through online, digital-first approaches. Now, this has become the industry standard, and not everyone writes the code themselves; instead, they seek out vendors who have already solved this problem and utilize their solutions.

So every new technology of the past has become a standard and indispensable step in future development.

Another way to look at this is first version fintech startups tried to break the ice by providing non-conventional solutions like

- eSign: (as explained above)

- penny drop: Its actually rupee drop to identify if the user’s bank name is matching with the name tagged to PAN.

- PGs: Payment gateways to transfer money from user’s account to sink’s.

- Aadhaar Auth: To authenticate user’s Aadhaar

- Mutual Fund Transactions: These are the APIs provided by the aggregators like MFU/BSE/NSE/MFU or individual AMCs

- Stock/Broker/Exchange APIs: These are the APIs provided by the online brokers and banks

- Prices/Nav APIs: Daily/hourly/live asset prices

- KYC: KYC registration agencies

- SMS: For OTPs and authentications

- Whatsapp: Its now default communication model for most fintechs in India.

And so on.

To create a comprehensive online platform for an instrument, one typically needs to incorporate approximately 10 or more vendor implementations. Each vendor has its own unique authentication and onboarding processes. Many vendors still rely on conventional data format stacks and protocols. For instance, despite the prevalence of REST and JSON in the industry, there are still numerous vendors who utilize XMLs and WSDLs.

Besides, due to the absence of a common protocol and data format, each vendor requires a new implementation that must be regularly maintained. It is quite common for vendors to change their protocols and formats.

In many cases, startups that serve as vendors may struggle due to insufficient funding or an inability to find a viable business model.

As a result, every new vendor has to start from scratch, working on compliance, onboarding, implementation, testing, and automation.

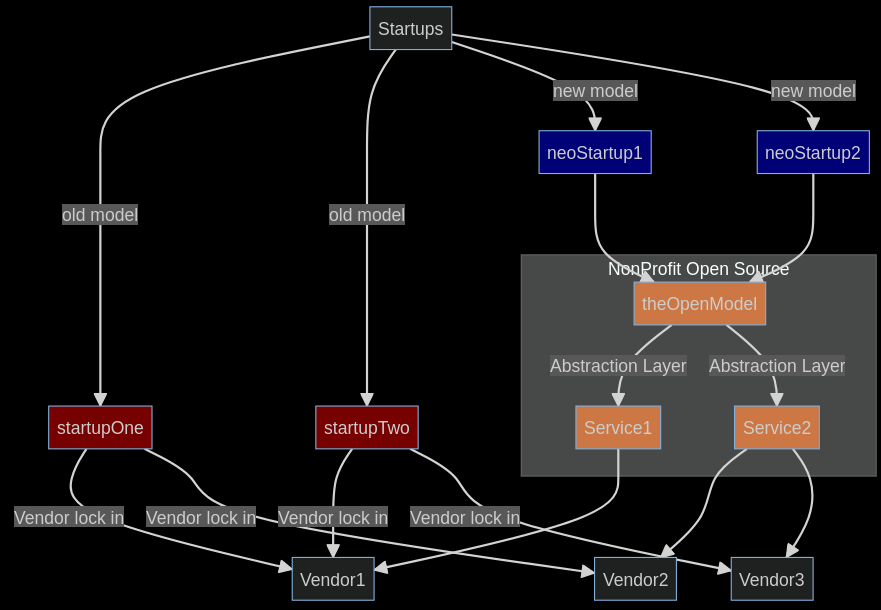

When looking at an individual company’s perspective compared to the market as a whole, one might argue that overcoming these barriers or eliminating competitors is the key. However, in this pursuit, companies (specifically the investors who supported the idea or problem) eventually lose momentum. Out of 100 companies registered in a similar domain, only 4 or 5 will remain active after 4 years. The remaining 95% will fail. This is not meant to criticize failure, but rather to highlight that these companies have no lasting legacy to carry forward. Nearly all of them would have allocated a significant portion of their tech budget to these vendor integrations.

Many would have vendor lock-in; it refers to a situation in which a customer becomes heavily dependent on a particular vendor’s products or services, making it difficult or costly to switch to an alternative vendor. This dependency arises due to various factors, including proprietary technologies, data formats, APIs, and contractual agreements that bind the customer to the vendor’s ecosystem.

To mitigate the risks of vendor lock-in, organizations often rely on an abstraction layer. An abstraction layer acts as an intermediary between the underlying vendor-specific technologies and the business logic or applications that utilize those technologies. It provides a standardized interface that shields the higher-level components from being tightly coupled to the vendor’s implementation details.

Hence there is a need of abstraction layer for every vendor integration.

What if these abstraction layers and created and managed by a neutral entity; say a not-for profit, section-8 company with Open protocol and Open data format?

- It will allow organizations to decouple their applications from the underlying vendor-specific technologies.

- An abstraction layer will promotes interoperability and portability. Ie., switch-in between the vendors will then be a offline task.

- Since code is open sourced, individuals can take the development further without a single point of failure.

That way, the 95% companies which are going to fail, would have contributed to this open model and their legacy or contributions will remain.

More important, every startup (new/old) rather than fixing the same operating problems can focus on the core industry problem and take the ecosystem on next level and thus achieving their goals and taking the solutions to next million or billion.

Tags: Fintech India Open Source

Updated on: 2023-07-19